April 25, 2024

F&B Supply Chain: Saving Water and Ensuring Resilience

Catalonia, Spain, has recently declared a drought emergency as reservoirs plunge to critically low levels at just 15% of full capacity. The ongoing drought has severely affected agriculture throughout the region, destroying nearly 8.5 million acres of crops. Exacerbated by climate change, the world is facing an existential water crisis.

Water is indispensable not only for drinking but also for supporting ecosystems and ensuring food security globally. Interconnected with this crisis, the food and beverage industry stands out as one of the most water-intensive and water-dependent sectors, with significant water impacts and requirements in agriculture, manufacturing, and distribution.

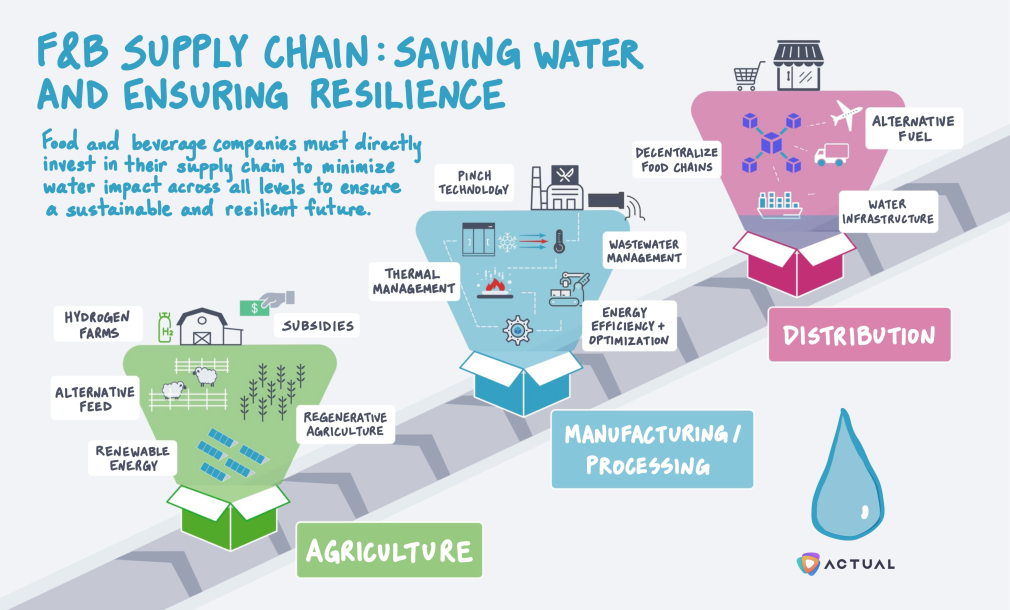

To ensure its long-term sustainability and resilience, the food and beverage (F&B) industry must invest in opportunities to directly reduce water usage across its supply chain, from farm to table, amidst rising demand and impending supply restrictions.

How does this affect you?

F&B CFOs and capital planning teams need to collaborate with suppliers across their supply chains to introduce incentives and financial assistance, fostering systemic changes that promise higher ROI in the future.

F&B sustainability teams need to prioritize investments aimed at enhancing business resilience, addressing both short and long-term outcomes for assets and products.

F&B operations teams need to pinpoint areas within their supply chain where they can minimize water impact, optimize conservation, and decrease unnecessary water loss.

Policymakers need to establish clear water regulations and resource management to address the water crisis proactively rather than reacting to drought consequences.

By 2050, the UN projects that the global population will reach approximately 9.7 billion people, requiring one hectare of land to feed five people by 2050, up from two in the 1960s. Even with improvements in water efficiency, more than two-thirds of the world lives in water scarcity for at least a month each year. Demand for water far exceeds our resources.

The water-food-energy nexus concept was introduced at the 2008 World Economic Forum to optimize and understand the interconnectedness across energy, water, and food. Water is essential for both energy production and food cultivation. By exploring this nexus, we can visualize how water plays a crucial role in the F&B supply chain.

AGRICULTURE. Agriculture, the largest water consumer, is responsible for approximately 70-90% of the freshwater usage. Despite its heavy reliance on water, the agriculture industry confronts substantial water restrictions during drought emergencies, sometimes reaching reductions of up to 80%, as observed in Colorado and, more recently, in Spain.

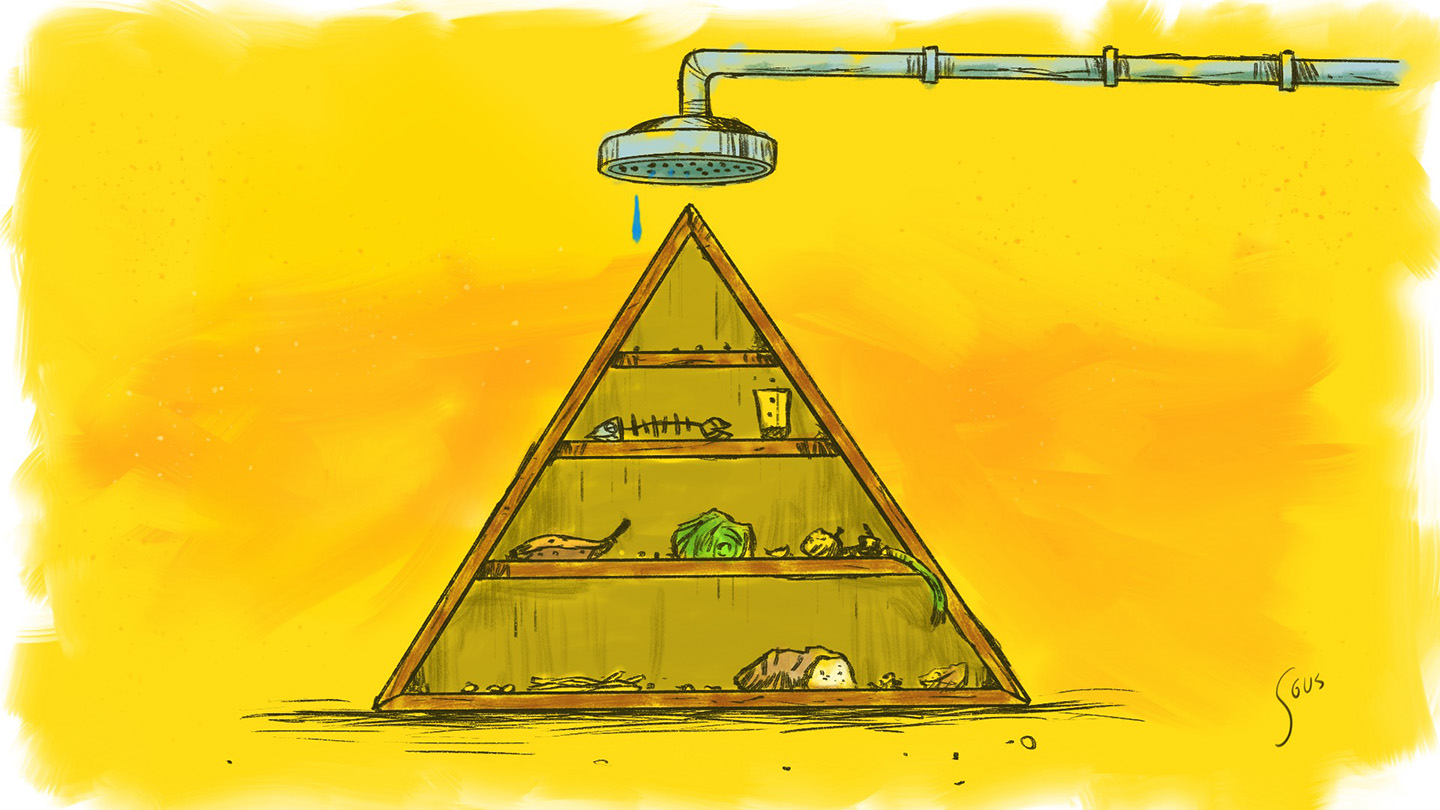

Furthermore, there is an evident trend of overconsumption of water and resources in agriculture. The heightened use of fertilizers and pesticides to maximize crop yields frequently results in surplus food waste of over 1.3 billion tons of food. Certain crops such as alfalfa and hay, commonly used for animal feed, require more irrigation water than others. As a result, continued use of excess water will lead to biodiversity loss and nutrient overload in natural watersheds, ultimately leading to a collapse.

PROCESSING & MANUFACTURING. The processing and manufacturing phase of the supply chain is notably the most energy-intensive. Significant amounts of water are used in the electricity generation process —nearly 12,000 gallons per MWh or 7.1 million Olympic-size swimming pools are used for producing electricity for food and agricultural sectors alone.

Certain processes and subsectors within the F&B industry are more energy-intensive than others. In the UK, animal products and baking accounted for approximately 30 - 40 PJ of energy demand, while soft drinks, fish, and oil and fat were the least energy-intensive, using about 5 PJ from 2002 to 2006. With further population growth today, energy demand has increased significantly. However, it's essential to recognize that even the least energy-intensive subsectors, such as oil crops and nuts, rank among the highest in water intensity in agriculture.

On top of energy usage, certain processes, such as washing, distillation, and heat processing — the highest water impact in thermoelectric processes — directly utilize water. It's also crucial to recognize that these figures do not account for the variety of products needed to manufacture the final product, including packaging materials and miscellaneous items such as cardboard and cork production for beverages.

DISTRIBUTION. Food now travels an average of 1500 - 2500 miles before reaching consumers, equivalent to a round trip from Rome to Berlin. Distribution systems must account for water impacts on the transportation network, as evidenced by the impact of the drought in the Panama Canal. Additionally, as we seek alternative fuels for aviation and maritime shipping, biofuel production also requires substantial water.

Investing in water conservation not only mitigates the water crisis but also yields significant financial benefits and savings with feasible payback periods. For instance, Kraft Heinz saved up to 53 million liters of water and $250,000 in water and energy costs in a single facility by investing in ammonia heat pumps, which capture heat energy from refrigeration. Optimizing heat pumps can yield an IRR of up to 60%. With successful implementation, Kraft Heinz has further received an additional $170M investment from the US Department of Energy.

What investment opportunities exist across the supply chain?

Agriculture outreach. Providing subsidies and promoting regenerative agriculture, which involves crop rotation to preserve soil health and biodiversity, enables farmers to safeguard both water quality and quantity, mitigating the adverse effects of excessive fertilizer and pesticide use on groundwater.

Technology optimization. Investing in energy-efficient technology, such as data collection and sensor equipment, will enhance logistics, resource efficiency, and waste management.

Pinch technology. Pinch technology identifies the “pinch point” where heating and cooling temperatures converge to reduce energy consumption and heat recovery loss. By investing in R&D, F&B companies can pinpoint processes that consume and lose significant amounts of water, allowing them to mitigate water impact.

Improve heat processes. Up to 60% of heat demands can be replaced with renewable energy, especially in improving areas in thermal management and waste heat recovery.

Decentralizing food chains. Decentralizing food chains enables companies to dynamically reroute around nodes facing stricter water restrictions and regulations, thereby enhancing business resilience.

Direct investment. Ultimately, water challenges within the supply chain, whether at a farm or manufacturing facility, will bring progress to a standstill. To ensure business resilience, F&B companies must directly invest across the entire supply chain to secure future returns.

In March 2023, Tunisia, one of the largest olive oil exporters, implemented emergency measures, including a nightly 7 hour water cut-off and a 6 month ban on freshwater use for agriculture. The challenges facing the F&B industry are parallel to those of other sectors, where the availability of raw materials and resources dictates the outcomes. However, food security and water access are fundamental human rights. At the end of the day, water is a finite source, and it is our responsibility to make sure the well does not run dry.

Until next time,

Actual

* Decarbonizing the food and beverages industry: A critical and systematic review of developments, sociotechnical systems and policy options: A comprehensive study of 350,000 sources of evidence and a short list of 701 studies.

More recent newsletters

April 11, 2024

ACTUAL

The automotive industry has been undergoing a drastic transformation, transitioning from combustion engine vehicles to include EVs, hybrid engines, and...

March 21, 2024

ACTUAL

The thrilling races of Formula 1 are powered by behind-the-scenes innovation, where even the slightest tweaks in aerodynamics or engine...

March 07, 2024

ACTUAL

Following COVID-19, the US is experiencing a shortage of large power transformers, crucial for connecting generation to our grid, delaying...