April 11, 2024

Biofuel Pressure on the Auto Industry

The automotive industry has been undergoing a drastic transformation, transitioning from combustion engine vehicles to include EVs, hybrid engines, and flexible fuel vehicles. The EU market exemplifies the diverse pace of adoption unfolding as a result of biofuel regulations and ban on petrol and diesel vehicles by 2035.

The EU is home to some of the most stringent biofuel policies. Under the recently adopted Renewable Energy Directive III (RED III), the EU has raised the renewable energy requirement in transport from 14% to 29%. What does this mean for the auto industry?

Major auto companies must recognize the significant market shifts resulting from biofuel regulations: whether a large-scale transition away from conventional fuels is successful largely depends on policy variations across Member States, as well as market conditions for biofuel availability and consumption.

How does it affect you?

Automaker R&D teams need to seize this transitional period to invest in the development of more energy-efficient EVs, in alignment with the EU's plans to phase out combustion engine vehicles.

Automaker capital planning teams need to analyze both the automotive and biofuel markets to determine optimal long-term investment plans for ensuring competitiveness and maximizing ROI.

Biofuel producers need to invest in increasing production of drop-in replacement fuels as the EU establishes explicit obligations for various fuel blends, imposing significant fines on non-compliant fuel suppliers and distributors.

Policymakers need to implement regulations that not only align with individual energy targets but also engage with other Member States to best position themselves in the EU market.

All EU countries are mandated to transition from conventional biofuels to advanced biofuels by 2030, as outlined in Annex IV (Part A and B) of the RED III, and further provisions outlining:

Transport energy. At least 5.5% of transport energy must be obtained from advanced biofuels derived from non-food-based feedstock and e-fuels, which are exclusively procured from 100% renewable sources.

Feedstock type. The EU has established explicit guidelines for gradually phasing out conventional biofuels derived from crop-based feedstock such as palm and soy. Specific provisions also set standards for classifying crop-based feedstock into "high" and "low" risk categories to facilitate this shift, eliminating some of the eligible feedstock in Annex IV for certain Member States.

Crop caps. Caps on crop feedstock also vary across EU countries: Belgium allows only up to 2.5% of crop feedstock for biofuel production, while Bulgaria allows the maximum, up to 7%.

Biofuel blending obligations are designed to meet GHG intensity reduction by requiring a specific percentage of biofuel in petrol or diesel compositions. Consequently, most major biofuel economies prioritize these goals to establish the standard.

However, only countries with the strictest compliance can continue selling to economies with similar or lower compliance standards. For example, while Finland can supply biofuel to all countries, Italy faces restrictions in compliant biofuel demand.

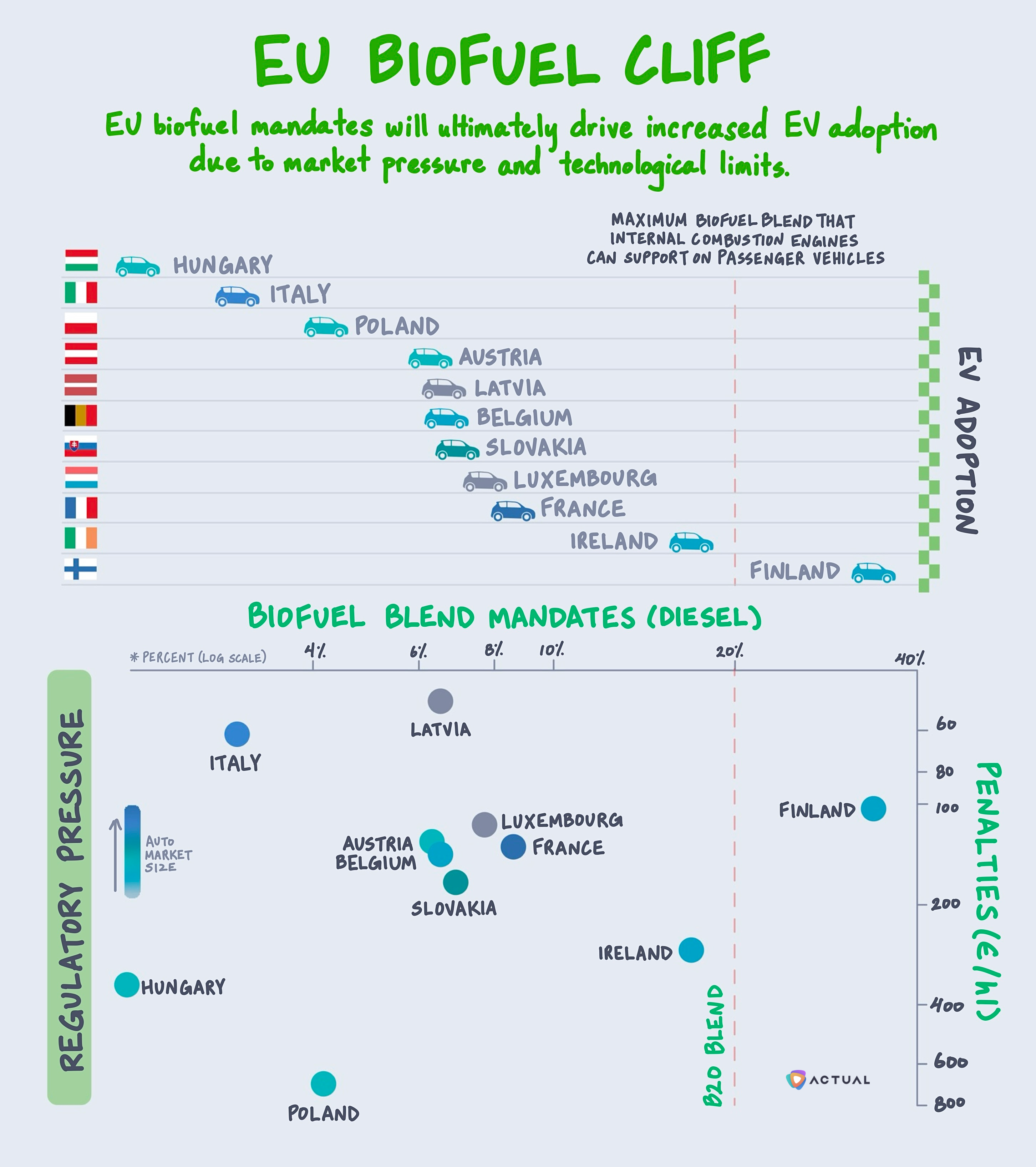

How do blending mandates affect the auto industry? Major auto manufacturers must plan for the future market taking into consideration stricter biofuel regulations and the impending ban of new petrol and diesel cars. The current biofuel threshold for average passenger vehicles is a blending of 20% (B20). Any countries left of this threshold are at risk for long-term competitiveness as the EU transitions towards EV adoption.

Finland. Finland's blending requirements are notably higher compared to other Member States at 34% by 2030. If flexible fuel vehicles cannot accommodate highly concentrated biodiesel as blending mandates increase over time, the country is more likely to transition to EVs at a faster pace.

Italy. With blending requirements at 3% and smaller penalties, Italy is in an interesting position. Home to many automobile manufacturers, it has the option to maintain current market demand by meeting minimum standards or capitalize on its position by investing in EV innovation and technology.

France. France is relatively well-positioned in market size and biofuel blending requirements. However, similar to Italy, French auto companies cannot afford to become complacent in their current markets, risking their long-term competitiveness.

Conversely, Germany, Sweden, and Austria, significant players in both the auto and biofuel markets, are well-equipped with incentives and penalties to maintain competitiveness in the future, particularly if blending mandates align with GHG intensity reduction goals.

While the long-term role of biofuel remains uncertain, biofuels are pointed to play a pivotal role in this transitional period. As long as cars, trucks, and planes are in use, there will be a demand for drop-in replacement fuels. The auto industry must embrace change and confront the wall of regulatory challenges head-on to unlock immense opportunities and potential: the grass (and roads) are greener on the other side.

Until next time,

Actual

* Removing additional incentives such as multipliers, which increase the target value of certain biofuels, and standardizing metrics across all Member States allows us to evaluate the impact of penalties and compliance measures on both the biofuel market and the auto industry. Compliance measures include biofuel targets and crop caps.

More recent newsletters

April 25, 2024

ACTUAL

Catalonia, Spain, has recently declared a drought emergency as reservoirs plunge to critically low levels at just 15% of full...

March 21, 2024

ACTUAL

The thrilling races of Formula 1 are powered by behind-the-scenes innovation, where even the slightest tweaks in aerodynamics or engine...

March 07, 2024

ACTUAL

Following COVID-19, the US is experiencing a shortage of large power transformers, crucial for connecting generation to our grid, delaying...