February 08, 2024

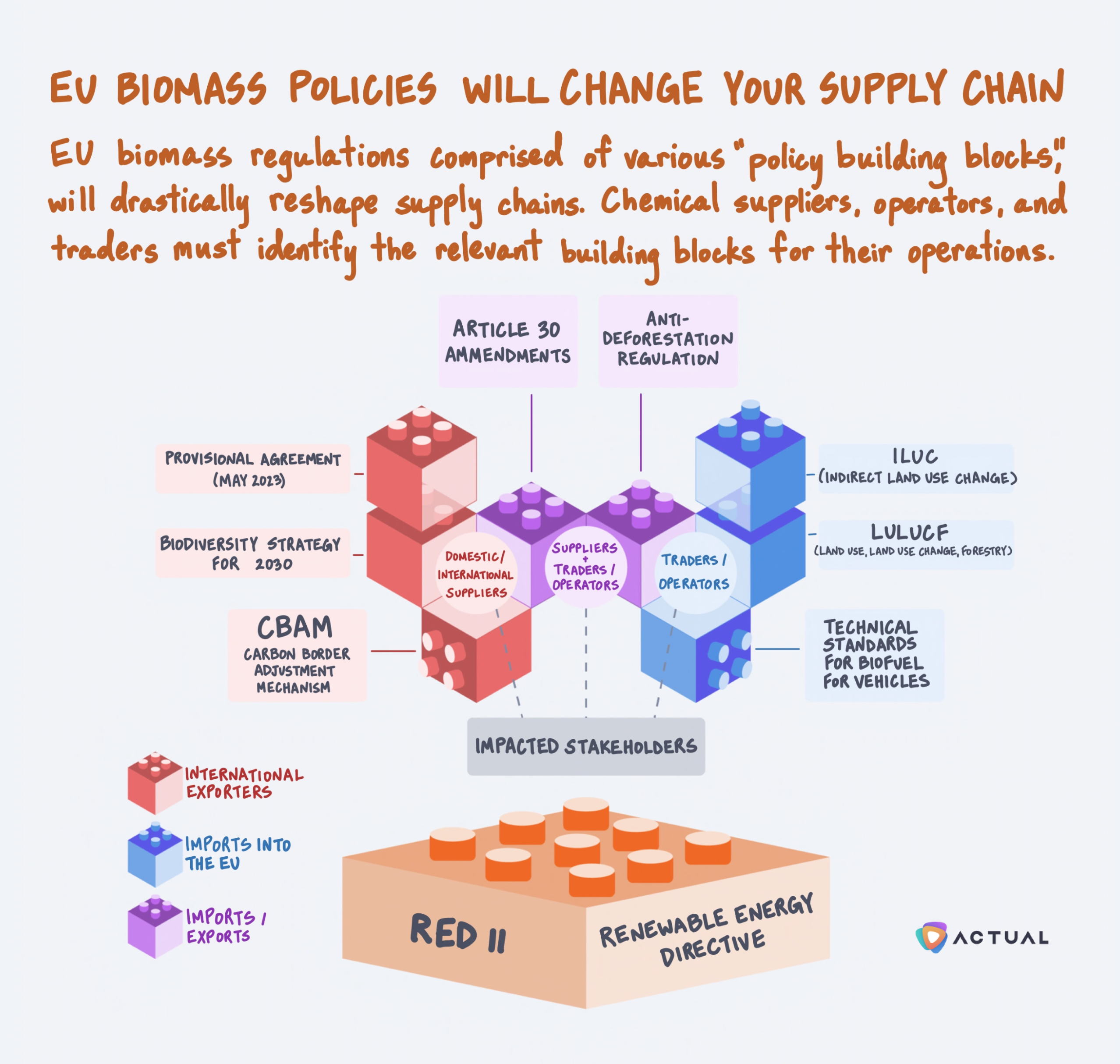

EU Biomass Policies Will Change Your Supply Chain

In 2024, the impact of climate policy hangs in the balance. With the impending implementation of long-awaited environmental policies, nations worldwide prepare for new elections while navigating supply chain disruptions from escalating political tensions on the Red Sea.

The chemicals industry is a prime example of an industry that will acutely feel the impact of global supply chain disruptions and evolving climate policy, especially in the European Union.

The EU has implemented stringent regulations on both domestic land-use policies and international biomass imports to support renewable energy targets, signaling a broader shift towards a green economy across all industries.

How does this affect you?

Chemicals CFOs and capital planning teams need to maximize long-term cost competitiveness and company viability by strategically investing in their supply chains ahead of disruptions.

Chemicals R&D teams need to explore advanced and alternative biomass feedstocks in anticipation of the EU’s transition away from conventional agrifood feedstock.

Investors need to pinpoint industry shifts and opportunities for both supply and demand within the chemicals sector to ensure the resilience of their portfolio.

Policymakers need to evaluate the implications of supply and demand changes on a global economic scale.

In recent years, the EU has accelerated its drive toward green energy adoption, particularly emphasizing green hydrogen and bioenergy, and ultimately increasing the need for raw materials. The EU is a significant intermediate importer of biomass (solid feedstock for bioenergy) and a major final trade exporter. This dynamic is shaped by stringent EU regulations that delineate biomass standards.

How do EU regulations impact imports into the EU and exports to the global supply chain? (Read more in Appendix A)

Imports. Specific criteria for land use policies in the EU restrict the expansion of agricultural land and the conversion of afforested land to grow feedstock. The European Commission, the EU's governing executive body, ensures accountability among Member States through comprehensive reporting requirements backed by new legislation, like the Anti-Deforestation law. As a result, chemical producers are encouraged to explore alternative investment opportunities and import resources.

Amidst the repercussions of climate change and declining yields, India, a key exporter to the EU, has implemented export bans on specific commodities crucial for biofuel feedstock, such as wheat and sugar. Consequently, due to unpredictable crop yields, the chemicals industry may face challenges in securing short-term supply.

Imports and Exporters. The EU has implemented strict policies on sourcing raw materials to address supply chain issues. The Anti-Deforestation law imposes traceability requirements for certain materials, regardless of country of origin. Consequently, this will influence existing trade networks and promote accountability in combating deforestation, particularly in countries like Brazil.

Article 30 of the Renewable Energy Directive (RED II) motivates Member states to ensure domestic suppliers meet decarbonization goals. International exporters are similarly encouraged to lower emissions and provide reporting to the EU, particularly for products classified as "high risk," like palm oil and soy.

For example, Australia, as the sole third country to do so, has submitted data to certify greenhouse gas emissions related to canola oil, which once used, is a popular feedstock for biofuels. This certification is crucial to comply with RED II requirements.

Exports. For other methods of energy production, the EU has committed to transition from conventional biofuels (agrifood feedstock) to advanced biofuels in energy production. This shift will inevitably affect sector-specific industries, exemplified by the biofuel standards for vehicles.

The EU has specified that CBAM will undergo progressive phases, potentially extending the scope of products subject to increased carbon taxes. Failure by international suppliers to invest in their supply chains now could result in higher costs in the future. EU import regulations are stricter than export regulations, emphasizing environmental sustainability in both inbound and outbound trade. While the EU may be well-prepared for the future, there are several challenges in the short-term:

Domestic Impact. As seen in recent protests around the EU, farmers are struggling under rising market costs and restrictive fertilizer and land use policies.

Time. The complex nature of both policy alignment and material changes in the supply chain can result in a significant mismatch between regulatory requirements and the practical feasibility of compliance.

Global definitions and standards. Each nation follows its own trajectory, resulting in varying definitions and standards, currently exemplified by varying definitions of conventional and accelerated biofuel in the US and EU.

The EU has effectively laid the groundwork for its green economy and energy transition. Yet, at its core, the success of this transition depends on the labor of everyone in the supply chain - all the way to the farmer. Therefore, policymakers must not only focus on reaping economic rewards but also prioritize investing in and providing financial resources to guarantee an equitable transition for all. Ultimately, it’s the farmers who sow the seeds, and without them, there won’t be any supply in the chain.

Until next time,

Actual

More recent newsletters

April 25, 2024

ACTUAL

Catalonia, Spain, has recently declared a drought emergency as reservoirs plunge to critically low levels at just 15% of full...

April 11, 2024

ACTUAL

The automotive industry has been undergoing a drastic transformation, transitioning from combustion engine vehicles to include EVs, hybrid engines, and...

March 21, 2024

ACTUAL

The thrilling races of Formula 1 are powered by behind-the-scenes innovation, where even the slightest tweaks in aerodynamics or engine...